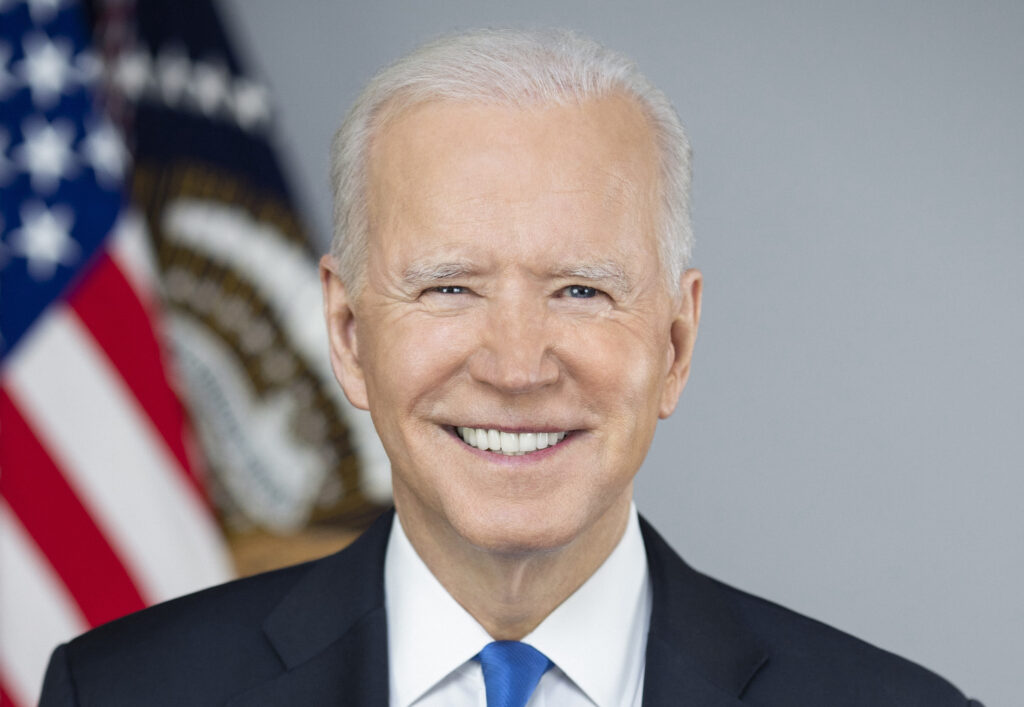

Good news for Joe Biden

Stemmed in large part by aggressive government stimulus, including the $1.9 trillion aid package President Biden signed into law last March, our economy is rebounding faster than expected and on track to regain all of the jobs lost during the pandemic by the middle of next year. It also stemmed from spending of savings built up during the pandemic.

This news comes from the Congressional Budget Office, a nonpartisan scorekeeper, predicting the economy will grow 6.7% for the year, after adjusting for inflation. That’s the fastest annual growth in the US since 1984, and significantly faster than Biden’s budget office had predicted earlier this year. The unemployment rate is expected to fall below 4% next year, and stay there for a number of years.

US Automakers have had a 40% increase in sales since this time last year, yet are struggling to increase production — all the more reason to pass President Biden’s American Jobs Plan and American Family Plan (infrastructure) sooner rather than later. The US economy is accelerating, consumer spending is robust, and jobs are plentiful, and car sales are expected to remain robust through the end of 2022, which would be even stronger were it not for the shortage in supplies.

And there is even more good news on the international front. President Biden claimed a victory Thursday in his drive for a global minimal corporate tax rate of 15%, when The Organization for Economic Cooperation and Development announced from Paris that 130 countries, comprising 90% of the global GDP, had signed on to the plan. Although it may take years to fully implement, this is more great news.

This includes an agreement taxing American tech giants Amazon, Google and Facebook, and is a great step in closing tax loopholes. “Multinational corporations will no longer be able to pit countries against one another, in a bid to push tax rates down and protect their profits at the expense of public revenue,” said Biden. “They will no longer be able to avoid paying their fair share by hiding profits generated in the United States or any other country, in lower tax jurisdictions. This will level the playing field and make America more competitive.” This just makes me want to scream, Yeeehaaww!