Score another one for President Biden

Although the April 15 tax deadline has passed, it’s not time to stop thinking about taxes. On the contrary, tax policy will play a major role in the upcoming November election. Using data from Morning Consult, 24/7 Wall St. recently reported that 61% of voters regard tax policy as “very important” when deciding their vote, indicating it is a top issue that will drive voter turnout.

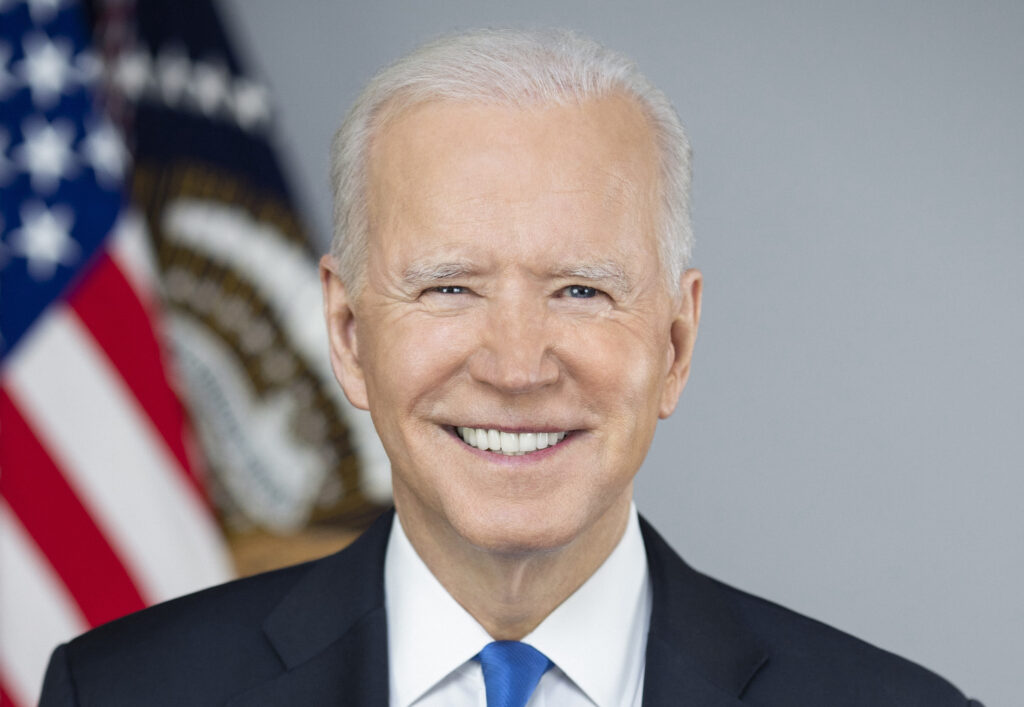

As President Joe Biden laid out in his State of the Union address last month, “Look, I’m a capitalist. If you want to make a million bucks—great! Just pay your fair share in taxes.” This straightforward, reasonable statement stands in contrast to standard Republican tax dogma, which prioritizes wealthy citizens and corporations at the expense of the middle class and, invariably, the U.S. economy.

To make the contrast clear for all voters, the Biden administration recently released a fact sheet that details the stark differences in tax policy with House Republicans. For example, the administration has proposed raising the corporate tax rate to 28% and making sure billionaires pay at least 25% in income taxes. In addition, the administration aims to extend programs such as the Child Tax Credit and the Earned Income Tax Credit, recognizing the significant benefits they offer when it comes to lowering the poverty rate.

The fact sheet also slams the Republican Study Committee (which represents 80% of House Republicans and 100% of their leadership) for its “extreme” budget proposal that offers $5.5 trillion in tax cuts to the wealthiest Americans, “doubling down on the failed approach of the Trump tax cuts.” Plus, if Republicans get their way, expected cuts in Social Security, Medicare, and Medicaid would devastate the middle class.

Tax season may be in the rearview mirror, but a vital election is only months away. Tax policy ranks among the most important issues, and voters’ decisions will significantly impact the future of the middle class along with the health of the American economy. As Benjamin Franklin astutely noted back in 1758, “We are taxed twice as much by our idleness, three times as much by our pride, and four times as much by our folly.”

Ron Leshnower is a lawyer and the author of several books, including President Trump’s Month