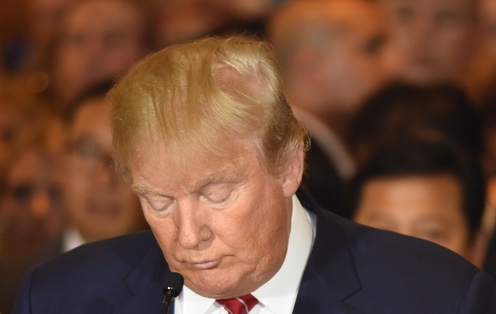

Trump and the GOP sink to a whole new low

While Donald Trump distracts everyone with his outrageous behavior, 21 Republican senators are actively trying to get rid of the capital gains tax. On its face, the capital gains tax may not seem like a big deal, but wiping it out would give yet another big tax break to those who don’t need one, the top 1% of income earners not to mention adding to our rapidly-growing deficit.

Led by Ted Cruz, Republican senators have asked Treasury Secretary Steven Mnuchin to employ executive authority and end “the taxation of inflation” by cutting the capital gains tax. The capital gains tax is simple: the sale of something of value that makes a profit creates a tax on that profit. Intuit gives simple examples of how this works: If you buy a used car for $3,000, and a week later, you sell it for $5,000, the $2,000 profit is considered a capital gain, and you have to pay taxes on that. Stocks and other investments made by the wealthy typically incur capital gains taxes, which brings us to why the Republicans want this tax removed.

While Intuit claims that “capital gains aren’t just for rich people,” they are for people who have money to burn on stocks and income properties. If you sell your own home, the tax doesn’t apply, however, if you are a “house flipper,” every time you flip a house for a profit, you’ll owe capital gains taxes. The Republicans would have us believe we’re all incredibly stupid, pointing to the strong economy and how businesses could use those taxes to hire more employees, raise wages, etc., but we’ve all heard that song and dance before. Besides, business income isn’t considered a capital gain.

Instead, as outlined by the LA Times, this is merely another tax cut for the top 1%. The Republicans, again assuming we’re stupid, outline in their letter to Mnuchin that cutting this tax will “help average Americans.” Yeah, right. How many Average Americans own stocks and investments? Not many, in any appreciable quantity. Most of us are just trying to make it from day to day. Further, they claim that capital gains don’t take inflation into consideration, which the Times says is a lie.

The Times points out that inflation is already embedded in the capital gains system in several ways. First, the tax rate is lower than taxes on wage income. Second, changing the tax system is merely a way to circumvent the House Ways and Means Committee. In fact, Edward Kleinbard, a tax expert, said that if Mnuchin goes along with the Republican Senators’ request, he will be breaking the law and will lose in a court of law.

Finally, the Times points out that this suggested tax cut would be “almost exclusively a rich person’s gimme” as the top 1% would secure 86% of any benefit while the bottom 90% would receive 2.5%. Worse, this cut would cost the Treasury $100 to $200 billion over 10 years, something we absolutely cannot afford.

Know your enemies, folks. Read the signatories to this continued robbery of the American people. This is getting really old. Republicans care nothing about the “average” American. We need representation that does.

Shirley is a former entertainment writer and has worked in the legal field for over 25 years